- Education

- Introduction to Trading

- Day Trading in South Africa

Day Trading in South Africa

Day trading differs from other forms of stock trading and investing in that it involves holding securities for only a single day. Engaging in day trading can be risky and stressful, particularly if one is unprepared.

However, day trading in South Africa has become much more accessible as there is no longer a need to seek advice from a financial advisor. Nowadays, individuals can purchase and trade stocks through their bank, as well as through numerous online brokerages and apps, which has resulted in a surge of interest in day trading.

KEY TAKEAWAYS

- Day trading is a type of stock trading where an investor buys and sells securities, such as stocks, options, currencies, or futures, within a single trading day.

- Scalping is a day trading strategy where traders make multiple trades within a day, aiming to profit from small price movements.

- Day traders take advantage of the momentum of the market and try to ride the trend as long as possible.

- Traders need to consider their day trading infrastructure, which includes modeling software, computer hardware, and data sources.

What is Day Trading

Day trading is a type of stock trading where an investor buys and sells securities, such as stocks, options, currencies, or futures, within a single trading day. The objective of day trading is to profit from small price movements in the securities being traded, typically leveraging large amounts of capital to maximize gains.

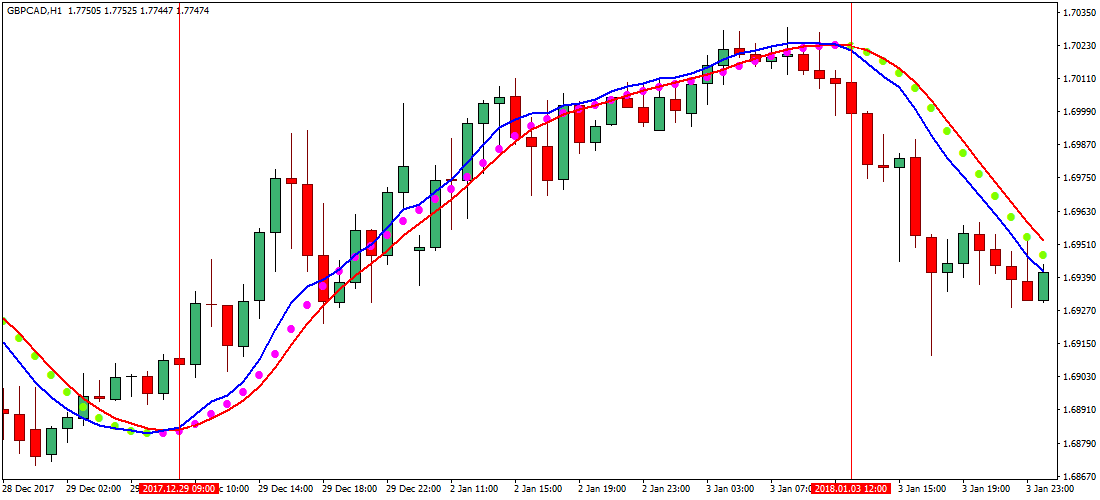

Day traders often use technical analysis and charting tools to identify potential trades and make rapid decisions based on real-time market data. Due to its fast-paced and high-risk nature, day trading requires a significant amount of knowledge, experience, and discipline.

If you are just making your first steps using a real trading account we suggest you read the How to Trade Stocks in South Africa article.

Day Trading Strategies

Day trading is a popular form of trading where traders buy and sell financial instruments within the same day. It can be a high-risk, high-reward strategy, but with the right knowledge and tools, day trading can be a profitable venture. In this article, we'll go over some day trading strategies and provide examples to help beginners get started.

Scalping

Scalping is a day trading strategy where traders make multiple trades within a day, aiming to profit from small price movements. Scalpers hold their trades for a few seconds or minutes, and they use technical analysis to identify entry and exit points.

For example, if a stock is trading at $50 and a scalper thinks it will rise to $51, they'll buy the stock and sell it as soon as it reaches their target price. The profit may be small, but if done consistently, it can add up over time.

Momentum Trading

Momentum trading is a day trading strategy where traders buy stocks that are rising in price and sell stocks that are falling in price. They take advantage of the momentum of the market and try to ride the trend as long as possible.

For example, if a stock is trading at $50 and has been consistently rising over the past few hours, a momentum trader may buy the stock and sell it when the momentum starts to fade. This strategy can be risky because momentum can shift quickly, but with the right analysis and risk management, it can be profitable.

Range Trading

Range trading is a day trading strategy where traders buy stocks when they're at the bottom of a price range and sell them when they're at the top of the range. Traders use technical analysis to identify price ranges and look for stocks that are likely to move within those ranges.

For example, if a stock is trading between $50 and $60, a range trader may buy the stock when it's at $50 and sell it when it's at $60. This strategy can be less risky than other day trading strategies because traders are taking advantage of established price ranges.

News Trading

News trading is a day trading strategy where traders buy or sell stocks based on news events. Traders monitor news sources to identify events that could affect the stock market and make trades accordingly. For example, if a company announces a positive earnings report, a news trader may buy the stock and sell it when the market reacts to the news. This strategy can be risky because news events can be unpredictable, but with the right analysis, it can be profitable.

In conclusion, day trading can be a lucrative venture for those who are willing to put in the time and effort to learn the day trading strategies and tools. Scalping, momentum trading, range trading, and news trading are just a few of the day trading strategies available to traders.

It's important to remember that day trading involves risk, and traders should have a solid understanding of risk management before starting. With practice and experience, day trading can be a rewarding and exciting way to invest in the stock market.

Day Trading Rules in South Africa

Day trading refers to the practice of purchasing and selling securities, such as stocks, within the same day, often multiple times. The South African government has established regulations that govern day trading, including day trading rules and guidelines for reporting gains and losses for tax purposes.

Taxes

When it comes to day trading profits in South Africa, they are classified as business income and are subject to taxation. On the other hand, losses can be deducted, so day traders can use them to lower the amount of taxes they need to pay.

South Africa Banks reports that government tax inspectors evaluate the performance of day traders by examining their behavior and intentions and categorize it as per capita growth or income from trading.

Assigned Security Accounts

In South Africa, day traders may hold both short-term and long-term investments, with retirement accounts commonly consisting of the latter. As securities in retirement accounts are typically traded less frequently than equity transactions, South Africa mandates the creation of separate accounts to hold different types of securities to ensure that activities related to each account are conducted separately for tax purposes.

No Margin Requirements

In contrast to the United States, South Africa has less stringent margin requirements for day trading.

FINRA investors define a "pattern day trader" in the US as someone who makes four or more same-day trades within five business days, representing more than 6 percent of their total trading activity during that period. If the day trader's account equity falls below $25,000, they cannot participate in transactions until it reaches the required limit.

To Sum Up

Day trading is one of those things that isn’t a fit for everyone but if you have an interest in personal finance and investing it may be something to look into. Make sure you start small to verify your interest and learn the different strategies and markets.

Practice with small investments before investing into large ones and gain some capital before making day trading your main source of income.

These little precautions can help maximize your income from day trading and limit your risk of loss. Even if day trading isn’t the best option for you, that doesn’t mean you can’t enter the investment market. A lot of these markets are great for investing at a small scale to earn some extra money.